Results at Wassa Include 65.7 Metres at 4.8 g/t Au and 17.9 Metres at 6.5 g/t Au

TORONTO, Nov. 13, 2019 /PRNewswire/ - Golden Star Resources Ltd. (NYSE American: GSS; TSX: GSC; GSE: GSR) ("Golden Star" or the "Company") is pleased to announce that it continues to intersect significant higher grade gold mineralization from infill and step out surface drilling on the southern extensions of the Wassa deposit ("Wassa"), demonstrating the continuity and overall robustness of this world class deposit.

HIGHLIGHTS

- Gold mineralization intersected on section 18,500N, 200 metres south of the current Inferred Mineral Resource demonstrates Wassa remains open for more than 1km south of existing underground infrastructure

- Infill drilling between sections 19,000N and 19,400N confirmed the continuity and grade of mineralization in this area, and helped improve the interpretation of the individual shoots

- Significant intercepts from Wassa are as follows1,2

- 65.7 m @ 4.8 g/t Au from 900 m in hole BSDD19-399D

- 19.9 m @ 5.2 g/t Au from 1,248 m in hole BSDD19-399

- 10.1 m @ 10.6 g/t Au from 369 m in hole BSDD19-401

- 17.9 m @ 6.5 g/t Au from 133 m in hole BSDD19-406D

- 11.2 m @ 11.4 g/t Au from 849 m in hole BSDD19-405M

- 14.8 m @ 6.8 g/t Au from 316.5 m in hole BSDD19-295D2

Wassa surface drilling during 2019 has continued to focus on increasing the size of and confidence in the Inferred Mineral Resource, and conversion of Inferred Mineral Resource to Indicated Mineral Resource through infill and step out diamond core drilling. A total of 22 holes have been completed for 12,636 metres since the end of Q2 2019, bringing the total drilled in the current year to approximately 45,000 metres from 59 holes.

The drilling has been successful in converting portions of the Inferred Mineral Resource to Indicated as well as better defining the Inferred Mineral Resource at depth and along the hanging wall and footwall lodes peripheral to the main B-Shoot mineralization. Infill drilling into the previously interpreted wide zones of gold mineralization at depth has shown that, instead of a single wide high-grade mineralized zone, there are four subparallel zones which have slightly less volume as previous interpretation but a higher grade, which we anticipate will result in roughly the same metal content. This new understanding will be incorporated into the ongoing geological interpretation update that will be the basis for the year-end Mineral Resource estimation (Figure 2).

WASSA SURFACE DRILLING - TESTING FUTURE UNDERGROUND TARGETS

Drilling results for 22 new surface diamond drill ("DD") holes totaling 12,636 metres have been received since the end of Q2 2019, thereby completing the 2019 budgeted surface drilling program.

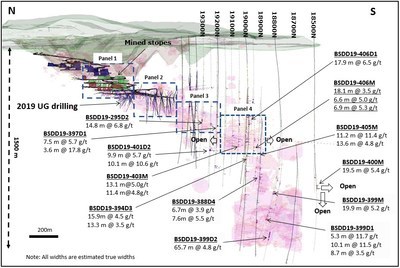

The isometric view shown in Figure 1 highlights a selection of significant results from holes drilled since Q2 2019, which will now be used to update the Mineral Resource Estimate for the year-end statement. Table 1 below, shows the significant assay results received since the end of Q2 2019.

Figure 1 - Wassa Underground: Isometric view looking east showing significant results of both step out and extension drilling programs1,2(Link to Figure 1 here)

Wassa Underground – Step Out Drilling Results1

Resource extension drilling to the south of the existing Wassa resource has continued to target additional resources using 200 metre spaced step out drill fences, with the last holes drilled on fence 18,500N (Figure 1). The results for BSDD19-400D1, 5.2 m @ 2.2 g/t Au and 8.9 m @ 2.8 g/t, on this fence, have extended the gold mineralized structure, although at lower grade, approximately 90 metres up-dip of the previously disclosed hole BSDD19-400M which returned an intersection of 19.5 m @ 5.4 g/t Au1. The additional mineralization intersected on section 18,500N will add to the Inferred Mineral Resource in this area. The mineralization of Wassa remains open along strike and down-dip, however mineralization appears to be pinching out in the up-dip direction on this most southerly drill section.

Wassa Underground - Inferred Mineral Resource Infill Drilling1

During the last quarter most of the Inferred Mineral Resource infill drilling focused on Panel 4 (Figure 1). Drilling in this area has confirmed the continuity of gold mineralization in Panel 4. Drill hole BSDD19-405M, which was drilled on section 19,050N, confirmed the previous Panel 4 mineralized intersections returning an intersection of 61.9 m @ 4.4 g/t Au, including several higher grade zones of 11.2 m @ 11.4 g/t Au and 13.6 m @ 4.8 g/t Au. This drilling has confirmed the continuity of zones previously reported on section 19,000N, in hole BSDD19-394D1, which returned 17.6 m @ 34.1 g/t Au and 15.7 m @ 4.1 g/t Au3.

New drilling on section 18,950N, 100 metres to the south of BSDD19-405M also intersected significant mineralization in Panel 4. Hole BSDD19-406M intersected 18.1 m @ 3.5 g/t Au, 6.6 m @ 5.0 g/t Au, and 6.9 m @ 5.3 g/t Au. BSDD19-406D1 on the same section confirmed an extension of the B-Shoot mineralization approximately 75 metres up-dip of the existing interpretation, intersecting 17.9 m @ 6.5 g/t Au.

The footwall mineralization where Panel 4 mining is being planned warrants further drilling to the north and south where the zone has not been tested thoroughly. The Company is currently looking at how best to test these extensions, either by surface or underground drilling.

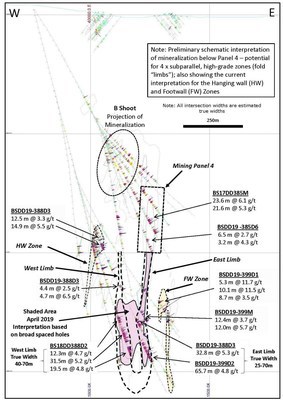

Additional drilling on section 18,900N (Figure 2) and 18,850N and 18,800N below Panel 4, has resulted in a preliminary change in the interpretation from what was modelled previously as a single moderate dipping thick lode, into a series of subvertical, subparallel, higher grade interpreted "fold limbs". Whilst these potential "fold limb" zones are not as wide as the original interpretation (based on 200 m spaced drill sections), the zones still have significant widths ranging from 25 to 70 metres at higher grades than previously intersected. The interpretation is currently being reviewed and will be used for the new Mineral Resource Estimate that will be updated in Q1 2020.

Wassa Underground - Inferred to Indicated Mineral Resource Conversion Drilling1

The Inferred to Indicated Mineral Resource conversion drilling continued on a 50 x 50 metre pattern and focused on the southern end of the current Indicated Mineral Resource between sections 19,400N to 19,300N. Results of this drilling should convert the Inferred Mineral Resource to Indicated with additions of hanging wall and footwall mineralization, as well as extensions up-dip and down-dip. Hole BSDD19-295D2, which was a 50 metre infill hole, intersected 14.8 m @ 6.8 g/t Au, slightly wider and higher grade than the two holes up-dip and down-dip on the same section.

Further resource conversion drilling will be completed from underground drill cuddies, with the existing drill access currently at 19,400N, and the Company plans to push this to the south as mining advances. Having underground drill access will significantly reduce the costs of converting Inferred Mineral Resource to Indicated Mineral Resource.

Figure 2 - Wassa Underground: Cross section 18875N looking north showing the change of the interpretation from a single lode to multiple lodes, based on infill drilling in the deeper extension areas (Link to Figure 2 here)

Wassa Cross Section 18875N – ( +/- 50 m window)

Significant Intercepts – Wassa Surface Drilling Results

The full set of drilling results released today is listed in Appendix A, which is posted to the Company's website or by following: http://www.gsr.com/operations/wassa/wassa-main/default.aspx including the significant intercepts set out below in Table 1.

Table 1

Wassa Surface Drilling – Significant Results Post Q2 2019

|

HOLE ID |

Azimuth |

Dip |

From |

To (m) |

Drilled |

~True |

Grade |

Drilling |

Target |

|

BSDD19-407M |

89.1 |

-66.4 |

526.0 |

536.0 |

10.0 |

6.2 |

6.8 |

Inf Definition |

B Shoot |

|

BSDD19-407M |

87.1 |

-67.4 |

763.0 |

780.0 |

17.0 |

10.4 |

3.1 |

Inf Definition |

B Shoot |

|

BSDD19-406M |

84.1 |

-60.6 |

821.0 |

853.0 |

32.0 |

18.1 |

3.5 |

Inf Definition |

PAN 4 |

|

BSDD19-406M |

83.4 |

-58.2 |

896.0 |

907.0 |

11.0 |

6.6 |

5.0 |

Inf Definition |

PAN 4 |

|

BSDD19-406M |

83.8 |

-59.8 |

926.0 |

938.0 |

12.0 |

6.9 |

5.3 |

Inf Definition |

PAN 4 |

|

BSDD19-406D1 |

87.3 |

-45.6 |

133.0 |

155.0 |

22.0 |

17.9 |

6.5 |

Inf Definition |

B Shoot |

|

BSDD19-405M |

84.8 |

-61.5 |

849.0 |

867.0 |

18.0 |

11.2 |

11.4 |

Inf Definition |

PAN 4 |

|

BSDD19-405M |

83.8 |

-61.9 |

873.0 |

881.0 |

8.0 |

4.9 |

8.7 |

Inf Definition |

PAN 4 |

|

BSDD19-405M |

83.2 |

-61.9 |

898.0 |

920.0 |

22.0 |

13.6 |

4.8 |

Inf Definition |

PAN 4 |

|

BSDD19-405D1 |

85.2 |

-47.1 |

389.0 |

400.0 |

11.0 |

9.3 |

5.8 |

Inf Definition |

PAN 4 |

|

BSDD19-405D1 |

88.6 |

-46.9 |

493.0 |

503.0 |

10.0 |

8.5 |

5.2 |

Inf Definition |

PAN 4 |

|

BSDD19-403M |

88.5 |

-60.3 |

805.3 |

821.3 |

16.0 |

9.8 |

5.0 |

Inf Conversion |

B Shoot |

|

BSDD19-403M |

86.6 |

-60.4 |

890.4 |

904.4 |

14.0 |

8.5 |

4.8 |

Inf Conversion |

B Shoot |

|

BSDD19-402M |

83.7 |

-58.1 |

936.5 |

947.6 |

11.1 |

7.1 |

4.7 |

Inf Conversion |

B Shoot |

|

BSDD19-401M |

88.3 |

-64 |

402.0 |

412.0 |

10.0 |

6.2 |

5.2 |

Inf Conversion |

B Shoot |

|

BSDD19-401D2 |

85.1 |

-70.7 |

172.8 |

191.8 |

19.0 |

9.9 |

5.7 |

Inf Conversion |

B Shoot |

|

BSDD19-401D2 |

82 |

-74 |

369.0 |

390.6 |

21.6 |

10.1 |

10.6 |

Inf Conversion |

B Shoot |

|

BSDD19-399M |

67.7 |

-61.8 |

1248.0 |

1283.4 |

35.4 |

19.9 |

5.2 |

Inf Expansion |

WUG deeps |

|

BSDD19-399M |

63.3 |

-56.6 |

1450.0 |

1469.5 |

19.5 |

12.4 |

3.7 |

Inf Expansion |

WUG deeps |

|

BSDD19-399M |

63 |

-55.7 |

1485.5 |

1504.0 |

18.5 |

12.0 |

5.7 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D2 |

67.6 |

-66.5 |

501.8 |

515.8 |

14.0 |

9.3 |

5.4 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D2 |

67.1 |

-65.2 |

668.4 |

685.0 |

16.6 |

11.3 |

6.3 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D2 |

65.5 |

-62.4 |

900.0 |

992.0 |

92.0 |

65.7 |

4.8 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

79.7 |

-55.3 |

480.5 |

491.0 |

10.5 |

6.8 |

6.2 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

77.7 |

-53.3 |

585.6 |

601.8 |

16.2 |

11.0 |

3.5 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

74.3 |

-52.8 |

690.3 |

705.0 |

14.7 |

10.1 |

3.6 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

70.8 |

-54.9 |

852.7 |

860.8 |

8.1 |

5.3 |

11.7 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

70.5 |

-54.9 |

888.6 |

904.0 |

15.4 |

10.1 |

11.5 |

Inf Expansion |

WUG deeps |

|

BSDD19-399D1 |

70.3 |

-53.9 |

922.5 |

935.5 |

13.0 |

8.7 |

3.5 |

Inf Expansion |

WUG deeps |

|

BSDD19-397M |

76.6 |

-72.9 |

666.0 |

683.0 |

17.0 |

13.2 |

6.8 |

Inf Conversion |

B Shoot |

|

BSDD19-397M |

80.3 |

-80.2 |

785.4 |

809.2 |

23.8 |

16.5 |

3.1 |

Inf Conversion |

B Shoot |

|

BSDD19-397M |

69 |

-79.8 |

963.0 |

980.6 |

17.6 |

6.1 |

9.3 |

Inf Conversion |

B Shoot |

|

BSDD19-397D1 |

85.6 |

-64.1 |

339.0 |

347.8 |

8.8 |

7.5 |

5.7 |

Inf Conversion |

B Shoot |

|

BSDD19-397D1 |

82.11 |

-64.4 |

358.6 |

362.8 |

4.2 |

3.6 |

17.8 |

Inf Conversion |

B Shoot |

|

BSDD19-394D5 |

86.6 |

-47.1 |

185.0 |

199.0 |

14.0 |

11.5 |

7.5 |

Inf Conversion |

B Shoot |

|

BSDD19-394D5 |

86.5 |

-47.6 |

260.0 |

280.0 |

20.0 |

16.3 |

3.4 |

Inf Conversion |

B Shoot |

|

BSDD19-394D4 |

93.1 |

-51.4 |

206.0 |

213.0 |

7.0 |

4.8 |

6.8 |

Inf Conversion |

B Shoot |

|

BSDD19-394D4 |

87.1 |

-53.9 |

351.0 |

364.5 |

13.5 |

8.9 |

9.7 |

Inf Conversion |

B Shoot |

|

BSDD19-394D3 |

84.2 |

-80.6 |

632.0 |

655.5 |

23.5 |

13.3 |

3.5 |

Inf Expansion |

B Shoot |

|

BSDD19-388D4 |

67 |

-81.7 |

683.4 |

693.3 |

9.9 |

7.6 |

5.5 |

Inf Expansion |

B Shoot |

|

BSDD19-295D2 |

82.2 |

-74.4 |

316.5 |

345.5 |

29.0 |

14.8 |

6.8 |

Inf Conversion |

B Shoot |

|

Notes |

|

|

1. |

All widths quoted in this press release are estimated true widths. |

|

2. |

Depths of holes annotated with "D" (daughter hole) are from wedge. |

|

3. |

See press release entitled, 'Golden Star Announces Drilling Results at its Wassa and Father Brown Deposits Including the Extension of Gold Mineralization at Both Locations', dated July 15, 2019. |

All monetary amounts refer to United States dollars unless otherwise indicated.

Company Profile:

Golden Star is an established gold mining company that owns and operates the Wassa and Prestea underground mines in Ghana, West Africa. Listed on the NYSE American, the Toronto Stock Exchange and the Ghana Stock Exchange, Golden Star is focused on delivering strong margins and free cash flow from its two high-grade, low cost underground mines. Gold production guidance for 2019 is 190,000 - 205,000 ounces at a cash operating cost per ounce of $800-$850. As the winner of the PDAC 2018 Environmental and Social Responsibility Award, Golden Star is committed to leaving a positive and sustainable legacy in its areas of operation.

Statements Regarding Forward-Looking Information

Some statements contained in this news release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and "forward looking information" within the meaning of Canadian securities laws include but are not limited to, statements and information regarding: the geological interpretation update that will be the basis for the year-end Mineral Resource estimation; the significant results from holes drilled since Q2 2019 that will be used to update the Mineral Resource Estimate for the year-end statement; additions to the Inferred Mineral Resources; further resource conversion drilling being completed and plans to push this to the south as mining advances; the reduction of costs of converting Inferred Mineral Resource to Indicated Mineral Resource; gold production of between 190,000 - 205,000 ounces in 2019; and cash operating cost per ounce of $800-$850 for 2019. Generally, forward-looking information and statements can be identified by the use of forward-looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes" or variations of such words and phrases (including negative or grammatical variations) or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Investors are cautioned that forward-looking statements and information are inherently uncertain and involve risks, assumptions and uncertainties that could cause actual facts to differ materially. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Golden Star will operate in the future, including the price of gold, anticipated costs and ability to achieve goals. Forward-looking information and statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of Golden Star to be materially different from those expressed or implied by such forward-looking information and statements, including but not limited to: risks related to international operations, including economic and political instability in foreign jurisdictions in which Golden Star operates; risks related to current global financial conditions; risks related to joint venture operations; actual results of current exploration activities; environmental risks; future prices of gold; possible variations in Mineral Reserves, grade or recovery rates; mine development and operating risks; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities and risks related to indebtedness and the service of such indebtedness. Although Golden Star has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in Management's Discussion and Analysis of financial conditions and results of operations for the year ended December 31, 2018 and in our annual information form for the year ended December 31, 2018 as filed on SEDAR at www.sedar.com. The forecasts contained in this press release constitute management's current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake any estimate at any particular time or in response to any particular event.

Technical Information

The technical contents of this press release have been reviewed and approved by S. Mitchel Wasel, BSc Geology, a Qualified Person pursuant to National Instrument 43-101. Mr. Wasel is Vice President of Exploration for Golden Star and an active member and Registered Chartered Professional of the Australasian Institute of Mining and Metallurgy.

The results for Wassa drilling stated herein are based on the analysis of saw-split HQ/NQ diamond half core or a three kilogram single stage riffle split of a nominal 25 to 30 kg Reverse Circulation chip sample which has been sampled over nominal one metre intervals (adjusted where necessary for mineralized structures). Sample preparation and analyses have been carried out at Intertek Laboratories in Tarkwa, which are independent from Golden Star, using a 1,000 gram slurry of sample and tap water which is prepared and subjected to an accelerated cyanide leach (LEACHWELL). The sample is then rolled for twelve hours before being allowed to settle. An aliquot of solution is then taken, gold extracted into Di-iso Butyl Keytone (DiBK), and determined by flame Atomic Absorption Spectrophotometry (AAS). Detection Limit is 0.01 ppm.

All analytical work is subject to a systematic and rigorous Quality Assurance-Quality Control (QA-QC). At least 5% of samples are certified standards and the accuracy of the analysis is confirmed to be acceptable from comparison of the recommended and actual "standards" results. The remaining half core is stored on site for future inspection and detailed logging, to provide valuable information on mineralogy, structure, alteration patterns and the controls on gold mineralization.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/golden-star-announces-continued-positive-drilling-results-at-its-wassa-deposit-300957803.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/golden-star-announces-continued-positive-drilling-results-at-its-wassa-deposit-300957803.html

SOURCE Golden Star Resources Ltd.